A financial redress agency (FRA) to serve as a single-window help

By Parsa Venkateshwar Rao Jr

A person who has been sold a wrong policy and loses money on that count does not where to turn to. Now, if the government accepts the recommendations of task force set up for the purpose, there will be one in place.

It was in his 2015 Budget speech that Finance Minister Arun Jaitley had promised to set up a redress agency for the retail financial consumer, the investor-on the-street.

The task force headed by Dhirendra Swarup, and comprising Prithvi Haldea, Monica Halan and Ajay Shah in its report submitted on 30 June 2016 has observed that the general observed the confusion in the situation, and cited the example that a complainant against a non-banking financial company (NBFC) cannot approach a the banking ombudsman. And some of the regulatory agencies cannot grant compensation even if they find a financial service provider at fault.

It has been suggested that the proposed financial regulatory agency (FRA), which should have a budget of its own of Rs 90-100 crore, and should comprise of qualified people and with a research wing to analyse data should serve as a single window clearance house for all financial consumers.

The task force recommended legislation for financial consumer protection and redress based on provisions included in the Indian Financial Code (IFC) as mooted by the Financial Sector Legislative Reforms Commission (FSLRC) set up in 2011 under Justice B.N.Srikrishna, and which had submitted its report in March, 2013.

Based on the finding of a study, the task force notes that more than trillion rupees were lost by investors due to the ‘mis-selling’ of Unit Linked Insurance Plans (ULIPs) between 2005 and 2012 and this shows the gap in the regulatory framework which leaves the consumer without redress.

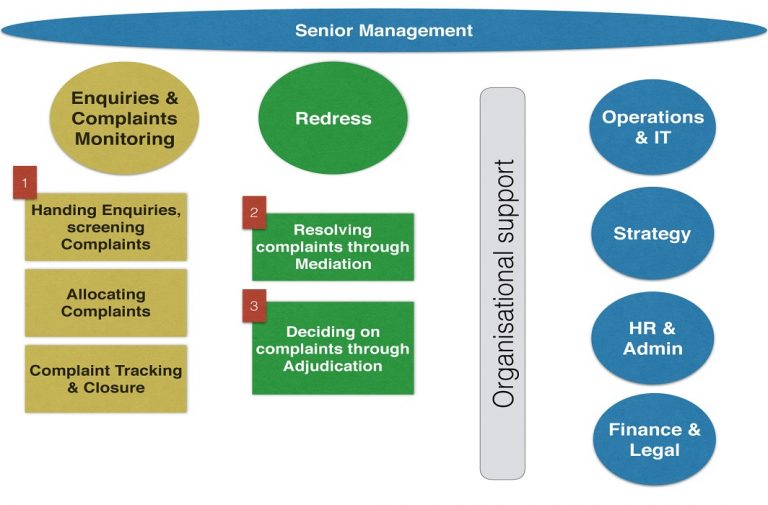

The FRA will process the complaints of the consumers and it will forward the complaint to the relevant authority and it will monitor the progress of the complaint as well.

It finds that regulators who are already in place as in the case of pension and insurance regulatory authorities cannot also serve as a redress agency and that there is a need for “an independent mechanism” to look at the complaints before they are sent to the relevant regulator.

The task force defines the proposed FRA as “a redress system for retail consumers, functioning as a specialized forum for complaints against regulated FSPs (Financial Service Providers) with a focus on mediation and light-touch adjudication.”