The Supreme Court has today agreed to examine whether smuggling of gold can be termed a terrorist act under the provisions of the Unlawful Activities (Prevention) Act (UAPA).

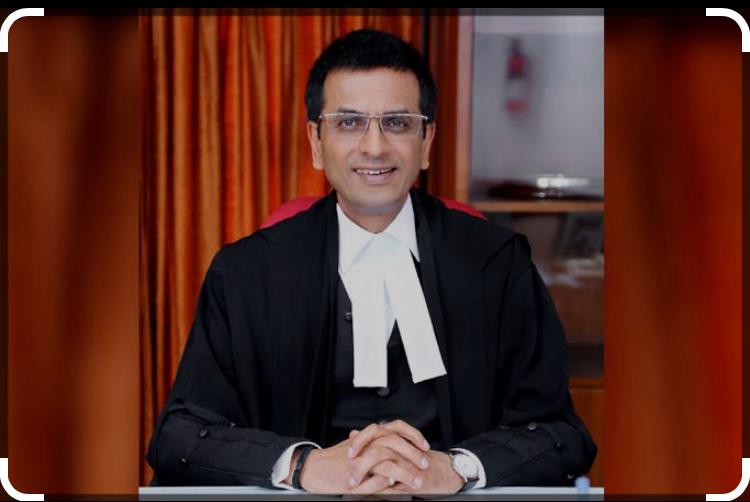

A bench led by Chief Justice N.V. Ramana and Justices A.S. Bopanna & Hrishikesh Roy was hearing a plea challenging the Kerala High Court judgment in a gold smuggling case. It issued limited notice to examine the question of law involved in the matters only, and not interfere with the bail granted to an accused person in the case.

During the hearing, ASG K.M. Nataraj appearing for the Centre has submitted that as per the order of the High Court, gold smuggling doesn’t fall under the category of suspicious activity.

CJI- It’s a matter of bail and all are employees of the government.

ASJ- Rajasthan HC has already taken a particular view and the same is under challenge before this court.

CJI- We will say question of law is open. If one SLP is pending, why should we allow this one?

“We issued Limited notice on the question of law and tag along with pending SLP,” ordered the Apex Court.

The Court has tagged the matter along with pending Special Leave Petition Crl No 2035/2021.

The Court was hearing the SLP (Criminal) challenging the Kerala High Court which had upheld the order of a trial court in granting bail to accused persons arrested in gold smuggling and charged under the Unlawful Activities (Prevention) Act.

On February 18, 2021, the Kerala High Court bench of Justices A. Hariprasad and M.R. Anitha had upheld a trial court order granting bail to 14 persons in a gold smuggling case. One of the bail applications was dismissed by the trial court and the accused has challenged that in the High Court, which was too disposed of with the same appeals. The National Investigation Agency had made all the arrests.

Allegations raised by the investigating agency, in brief, are that on July 5, 2020, the officers of the Customs Department seized 30 kg of 24-carat gold, from International Airport, Thiruvananthapuram. The NIA alleged the gold was smuggled through the diplomatic channel pursuant to a conspiracy hatched by the accused. It was further alleged by the NIA that the proceeds of the smuggled gold could have been used for financing terrorist activities in India.

The NIA counsel contended that the accused have smuggled gold with an intent to threaten the economic security of India as provided in Section 15(1)(a)(iiia) of UAPA. Thereafter, it was argued by the counsel for the accused that the words “any other material” do not specifically refer to smuggling of gold.

While deciding the present case it was observed by the court that “No doubt, the property meant and defined under Section 2(h) of the U.A.(P) Act must be something having some value in ordinary transactions, whether it is tangible or intangible, or movable or immovable or corporeal or incorporeal. Valueless objects cannot be covered by the term property. The finance of the country is included in the definition of property. Finance is a broad term covering so many aspects of monetary set-up, and it is not something that can be simply called property. To be property as meant under the law, the object must satisfy the definition of property under Section 2(h) of the U.A.(P) Act. Finance of the country is something different, having broader connotations and applications in the country’s economic set up, and it cannot be brought down to a narrow concept or object as property. So also, the term “security” occurring in S.15 of the U.A. (P) Act cannot be stretched by interpretative process to include economic security. To understand what exactly security is, as meant by law, the whole section must be read and appreciated carefully. It is quite clear from such interpretation and understanding that the term security meant under the law is the country’s security vis-a-vis., law and other situations and internal or external affairs of the country, and not financial or economic fabric. When the parliament in its wisdom realised that economic security of the country also must be brought within the definition of terrorist act, the Parliament inserted the words ‘economic security’ specifically in Section 15 of the U.A.(P) Act by a specific amendment. Though generally the objects and reasons of a statute cannot be given much weight or value or importance in the process of interpretation, the objects and reasons of the Unlawful Activities (Prevention) Amendment Act, 2012 will clearly indicate that the Parliament inserted words to cover economic security in Section 15 of the U.A.(P) Act because the existing provision did not cover such situations or instances of acts like smuggling or circulation of high quality counterfeit Indian paper currency causing damage to the finance of the country and economic stability of the country.

We find that the Parliament in its wisdom inserted the words ‘economic security’ in Section 15 of the U.A.(P) Act, and also introduced clause (iiia) in Section 15 regarding production or smuggling or circulation of ‘high quality counterfeit Indian paper currency’, making it an act of terrorism within the meaning of Section 15, only because the existing provision did not take care of such situations and acts, and a provision was felt absolutely necessary by the Parliament to punish production or smuggling or circulation of high quality counterfeit Indian paper currency as a terrorist act damaging or destroying the monetary stability of India and the economic security of India. We, thus come to the conclusion and finding that production or smuggling or circulation of high quality counterfeit Indian paper currency was not punishable till 01/02/2013 under Section 16 of the U.A.(P) Act as a terrorist act defined under Section 15 of the U.A.(P) Act.”

But the court also added that the smuggling of gold is neither specifically mentioned in the Section 15 of the UAPA nor it is anywhere mentioned in the 3rd Schedule of the Act.

Another contention raised by NIA is that the gold cannot be smuggled because under the Customs Act, smuggling is an offence against levying duty. On this point, the High Court observed that the word “smuggling” is not defined under the UA(P) Act and definition of a particular expression occurring in one statute cannot be applied to another, unless they are pari material, this is an indisputable proposition. And the court came to conclusion that the Customs Act and UA(P) Act are not pari material. Therefore the meaning of smuggling cannot be derived from the Customs Act.

Thereafter, the court went by the dictionary meaning of “smuggling” and observed that smuggling means illegal transportation of objects, substances, information or people, such as out of a house or building, into a prison or across an international border in violation of the applicable laws or other regulations. Cambridge Dictionary defines the word “smuggling” as an act or process of taking things or people to or from a place secretly and often illegally. In all cases, smuggling need not be in respect of articles on which a duty could be levied. For example, narcotic drugs or other contraband articles are smuggled at times on which no duty could be levied. In our opinion, “smuggling” is a generic term indicating the illegal transport of various articles.

Also Read: Justice Chandrachud says state should not misuse anti-terror laws to quell dissent

The High Court said that the arguments raised by NIA cannot be accepted and the learned trial judge was right in holding that the materials presented before the court at the time of considering the bail application did not reveal prima facie that the accused persons released on bail are involved in a terrorist act, as defined under Section 15 of the UA(P) Act.

The High Court held, “On a perusal of the operative portion of the bail order, we find that the trial court has carefully taken enough precautions to see that the accused persons, to whom bail had been granted, are obeying the directions and they do not interfere with progress of the investigation. Similarly, measures have been taken in the bail order by imposing necessary conditions to secure their presence at the time of trial. Therefore, we find no reason to think that the accused to whom bail had been granted will flee from justice or meddle with the investigation. Moreover, the investigating agency, if succeeds in digging out materials to show their complicity in a terrorist act, certainly can move the court for cancellation of bail.”

The Court has also rejected the challenge made by one of the accused against cancellation of his bail by the trial Court while stating that he had played a pivotal role in the alleged conspiracy. “Various accused persons obtained smuggled gold through 7th accused. Allegations against him are certainly graver than those against the accused who were enlarged on bail. Therefore the court below rightly declined his bail plea,” the High Court noted.

.png)

.jpg)

_(1).webp)

.jpg)

.jpg)

.webp)