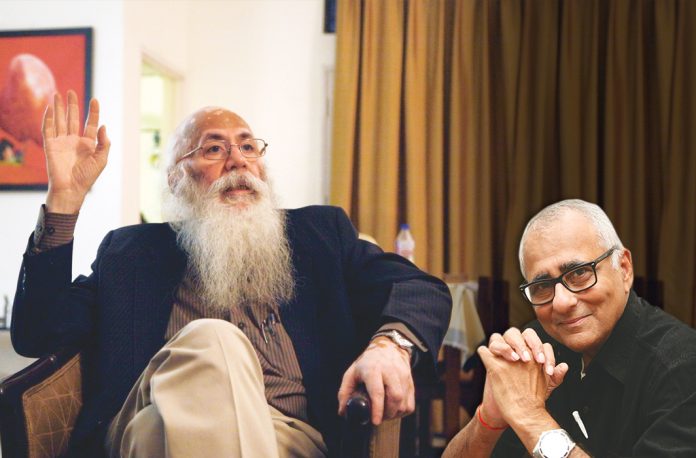

Professor Arun Kumar is perhaps among the most distinguished economists of the world whose works on the black economy are considered the holy grail of knowledge on the complex subject. He has written, studied and lectured extensively on the subject for nearly four decades. He studied at Delhi University, Jawaharlal Nehru University (JNU) and Princeton University, USA, and taught economics at JNU for three decades till 2015. His areas of interest include public finance, development economics, public policy and macroeconomics. Kumar has written widely on these subjects, both in the popular press and for academic journals. At present, he is the Malcolm S Adiseshiah Chair Professor at the Institute of Social Sciences, New Delhi.

When Prime Minister Narendra Modi demonetised 86 percent of the Indian currency in circulation in November 2016, he predicted in an exclusive interview with India Legal how this hasty drive would adversely impact demand, employment and investments and plunge the economy into a dangerous downward tailspin. He then prognosticated that three shocks in quick succession—demonetisation, the hasty and poorly implemented Goods and Service Tax and the crisis in the non-banking financial companies could irreparably damage the functioning economy.

The government was in denial. Kumar was right. The Indian economy has entered a full-blown recession. The latest Union Budget seems unable to cope with this economic catastrophe. Is all lost? Can anything be done to start healing the self-inflicted economic sores, or will they continue to fester and bleed the nation into more unemployment, poverty and misery, as demand, consumption, jobs, investment, imports and exports crash? Is the social unrest raging across the country a sign of this economic crisis—citizens venting their fury on fellow citizens as the government tries to hide its economic blunders behind emotive and divisive agendas?

That’s another subject. But right now an analysis of where India is headed economically, whether the new Union Budget tried to grapple with the real problems and what curative measures are necessary need to be discussed. And who better to lead the discussion than Arun Kumar who made a brilliant, cogent and pithy point-by-point presentation at a private seminar organised by Dr Kulwant Singh, past General Secretary of the National Media Centre, in Gurgaon. Dr Singh who also serves with the United Nations, and is CEO, 3R WASTE Foundation/Urban Policy, was kind enough to send me a copy of Arun Kumar’s presentation which I reproduce in full below for the benefit of both the generalist and the specialist who, I am sure, will be motivated to plunge into further research after absorbing the points Kumar makes succinctly and with such clarity:

BUDGET OBJECTIVES

- The Union Budget has two goals. Tackle the current problems and fulfil the government’s vision.

- Current: The economy has slowed down/it is in recession.

- Vision of doubling farmers’ incomes by 2022 and achieving a GDP of $5 trillion by 2024.

- Not feasible with an economy that is slowing down or in recession.

- The two aspects are indeed interlinked; they become one and same.

- So, objective, how to boost the economy in 2020-21.

- Much confusion about data on growth.

- Something pretty drastic needed to be done in the Budget.

NOT A SLOWDOWN BUT A RECESSION

- Three shocks in the last three years.

- Damaged the unorganised sector, employing 94 percent of the workforce and producing 45 percent of the output. It is increasingly marginalised.

- Indian economy growing at less than 1 percent for the last three years and not at 5 percent or 7 percent as officially claimed. -ve rate now.

- Every 1 percent less growth means Rs 2 lakh crore less income.

- Most of it from unorganised sectors.

- Income distribution gets more skewed.

WHAT DATA FOR UNORGANISED SECTOR?

- Official GDP data does not account for unorganised sector independently.

- Method needed to change after demonetisation.

For 29 of 38 sub-sectors of unorganised sector, the data used is from the organised sector. Namely, ASI, IIP, Motor vehicle sales, Sales Tax, corporate sector growth and service tax

- For quarterly data, only some organised sector data available – corporate announcement by a few hundred companies.

POINTERS TO RECESSION

- Evidence of decline in growth:

- IIP, core sector, freight traffic, retail, sectors like auto in negative growth, FMCG growth slowdown, tax collections less than BE, investment rate, real consumption decline in rural areas, credit off-take low, etc.

- RBI says capacity utilisation is 70 percent, consumer confidence and business confidence have declined.

- Investment rate has not risen in spite of stock market at record levels and reduction in interest rates due to RBI action.

DEMAND SHORTAGE

- Crisis induced by policy shocks in last three years – not a cyclical issue.

- Problems began with unorganised sector after

- GST exempts unorganised sectors, but there is a structural flaw.

- Income and wealth distribution getting more skewed leading to aggravation of demand problem.

- This is a continuing problem but it is aggravated by the shocks to the economy and especially unorganised sectors.

- Demand shortage from unorganised sectors to organised sectors.

BROAD VISION IN THE BUDGET

- To spend Rs 30.42 lakh crore, 13.3 percent of GDP for 2020-21.

- Can be used to give to every section and sector of society.

For senior citizens, SCs and STs, farmers, women…

- Deeper the crisis longer the speech.

- It is structured around three themes a) “caring” society, b) Aspirational India and c) Economic development for all.

- 16 action points are listed as the focus of the government.

FOCUS POINTS LISTED IN THE BUDGET SPEECH

- Rs 103 lakh crore investment on infrastructure in five years.

- Disinvestment accelerated – LIC shares to be sold via public offer.

Target of Rs 210 lakh crore as against Rs 65,000 crore last year

- Improved governance and respect for wealth creators

- Creation of a Taxpayer’s Charter – Problem of Tax Terrorism

- Lower income tax rates if people do not resort to concessions and deductions; choice to stay with the old system or migrate to new one

- Dividend distribution tax (DDT) to be done away with

MACRO ASPECTS OF THE BUDGET

- It is first a macro exercise and then a micro one

- If revenue short, either cut back in expenditures or deficit rises.

- Happened in both 2018-19 and 2019-20

- In 2019-20, revenue shortfall of Rs 3 lakh crore.

- So, expenditures cut back – aggravated the demand problem.

- In 2020-21 too, revenues may be less and expenditures may be cut.

- From Public Sector via IEBR – 40 percent increase in 2019-20

- Disinvestment from (RE) Rs 65,000 crore raised to Rs 2.1 lakh crore.

TAX CUT OR INCREASE IN EXPENDITURES?

- How can Budget help increase demand in the economy?

- Will increase capacity utilisation, in turn spur investment and lead to higher rates of growth

- Tax cut or increase in expenditures. Both increase deficit

- Corporate tax cut led to boom in stock markets without causing investment to rise. RBI cut interest rates five times last year but investment rate has not picked up.

- Fiscal deficit raised without demand going up

- If spent on unorganised, demand would immediately rise.

POLICY FOCUS REQUIRED

- Rather than tax cuts/concessions to organised sectors, increase investments

- Focus on the unorganised sectors and rural areas first

Farmers’ incomes have to be boosted

Higher allocations are needed for MGNREGS

Need a scheme like MGNREGS for urban areas

Increase access to credit to micro and small sectors

- Disaggregate MSME between Micro and Small and Medium sectors

- GST has to be structurally altered – make it a last point tax.

The benefit of computerisation and VAT being mixed up.

FISCAL DEFICIT OF CENTRE, STATES & PUBLIC SECTOR

- Centre cut taxes, used incorrect revised estimates, growth assumed 12 percent, actually growing at less than 8 percent

- Total revenue shortfall is 1.45 + 1.6 + 0.44 = Rs 3.49 lakh crore

- Centre would lose 58 percent, so, about Rs 2.02 lakh crore

- States will lose = Rs.1.47 lakh crore

- Additional expenditures by centre will be 70+50+20 = 1.4 lakh crore

- Centre got additional Rs.60,000 crore from RBI

- Disinvestment target short by Rs.40,000 crore (conservative estimate)

- The total FD would be 4.63+2.4 (PSU) +3.73 (states) = 10.76 percent

WHERE TO RAISE RESOURCES?

- Given huge income and wealth disparities,

- Use wealth tax, estate duty and gift tax to raise resources.

Even Soros and western rich suggest this

- Raise direct taxes and

- Cut indirect taxes on basic and essential goods and services

- Not a zero sum game

- Invest additional tax resources in employment generating rural infrastructure – health, education, drinking water, communication, etc.

CONCLUSION

- Since fiscal deficit is high, there is need for resources to boost expenditures

- With the high level of disparity, wealth tax, estate duty and gift tax can be revived to obtain resources from the top 1 percent

- These be spent on the unorganised sector, employment and incomes

- This would be a positive sum game – also benefit businesses

- Why is the budget not doing the obvious?

Lead picture: Anil Shakya