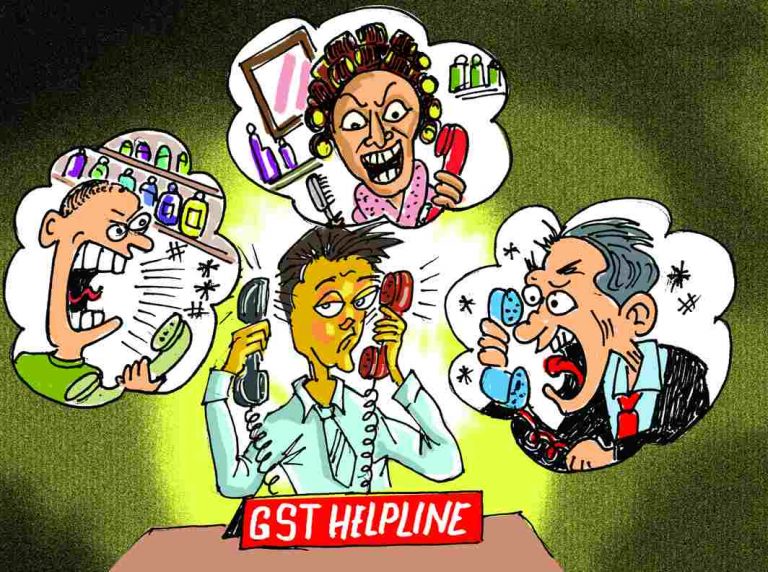

Above: Illustration Anthony Lawrence

~By Dilip Bobb

GST has now overtaken Duckworth Lewis in the list of things one cannot understand. Reading the myriad articles by tax experts trying to explain GST has only confounded confusion. If these experts all differ on the benefits and drawbacks of the scheme, what hope is there for us mere mortals? There is, however, providence in the form of a dedicated helpline. Here is a recording of conversations post July 1.

Caller 1: Hello, is that the GST helpline?

Helpline: Yes madam, Shalom!

Caller 1: Are you a Nepali?

Helpline: No madam, I am going by what’s trending on the PM’s Twitter account. We all follow it beautifully,… I mean dutifully.

Caller 1: Oh, I thought you were a Nepali saying salaam. Anyway, after an hour of being put on hold and going deaf listening to Vande Mataram, finally I have someone who can hopefully, and dutifully, answer my queries. Why has my beauty parlour bill gone up so much? And my poor Moti, why has dog food gone up so high?

Helpline: Madam, I suggest you go to the GST website, all your questions are answered there… dog queries should be addressed to Maneka Gandhi. You can go to her website.

Caller 2: I am calling because I don’t use a computer. Now, Amitabh Bachchan says one country one tax, but in my kitty party bill, there is state GST, Central GST and Integrated GST, why so?

Helpline: I suggest you call Mr Bachchan, as GST brand ambassador he will know these intricate details.

Caller 2: What is his number?

Helpline: Please go to his website….

Caller 2: What is the point of a helpline if I keep getting told to go to a website? This is getting nowhere. Now wait, my husband has some questions for you.

Caller 3: Tell me, I have just filed my IT returns. Do I have to file one again post GST?

Helpline: Sir, I am sure our IT section would know that. You can go to their web….

Caller 3: I am talking about income tax, now please don’t tax my patience.

Helpline: Sir, for outpatient it is 16 per cent and for other patients it is….

Caller 3: I said patience, which I am about to lose. I have a simple question and I need a simple answer.

Helpline: Sir, this is a Good and Simple Tax. GST has united the country like Sardar Patel did after Independence. This is for a new economy in a new India, it is a historic moment, a moment that comes but rarely in history.

Caller 3: I have heard all the midnight hour speeches and it’s giving me a headache.

Helpline: Sir, for headache, there is very good Patanjali product, I have tried it myself….

Caller 3: Are you even qualified for this?

Helpline: Sir, I am GST pass. Your time is up. We have waiting caller number 420 on the line. This is the helpline, how can I help?

Caller 4: My battery has gone down 28 percent waiting for someone to pick up. Is that tax deductible? Has VAT 69 been renamed GST 69? Can Amitabh Bachchan explain why he is endorsing GST while prices of cinema tickets have gone up? Will those who oppose GST be made to appear on Republic TV to be branded as anti-nationals?

Helpline: Sir, even Amitabh Bachchan does not have so many questions for contestants on Kaun Banega Crorepati. Please go the website…

Caller 4: You are manning the helpline but it looks like you need the most help.

Helpline: Just doing my duty sir, as Modiji says in his speech, all duties are now one GST. Next caller please?

Caller 5: I am a small trader. I believe GST is a conspiracy to sell computers in India. There are millions of small traders who now have to buy a computer to do invoicing and calculate taxes. These computers will come with a virus which will steal all my money. What is it called? Pissing, fishing…?

Helpline: Sir, for conspiracy theories, there is a different helpline, it was Delhi Chief Minister Arvind Kejriwal’s number, now it is Lalu Prasad Yadav.

Caller 6: I have a question. My wife is registered as an employee in my business but she is also very demanding when it comes to expensive jewelry, designer clothes and five star hotels. How do I save my marriage and still keep within the Rs 50,000 cap on gifts to employees?

Helpline: Sir, for marriage counseling I can recommend my brother-in-law, he has his own website….