Both the GST Council and taxpayers will have to look at this new tax regime as “work in progress” for at least one more year, and continue to take quick corrective actions

~By Sumit Dutt Majumder

It’s been nine months since India implemented GST. There cannot be any doubt that the country needed it. Efforts were on since 2006 to get this tax regime implemented. Finally, it was introduced in July 2017. The question now is how has the GST regime worked since its launch.

Before coming to GST revenue collection, which, of course, is of paramount importance, let us first look at some fundamental issues. Did the policy decisions work out well? Were they properly implemented? Was the technology support adequate? What was the impact?

One of the five basic aims of GST was to substantially reduce, if not totally eliminate, the cascading of taxes by providing seamless flow of input tax credit at each stage of the flow of goods and services in the supply chain. The second aim was to cut down the compliance costs by clubbing together 17 indirect taxes of the centre and states. These two targets have been achieved substantially, except that five petroleum products and alcohol for human consumption could not be brought within GST. This broke the credit flow and dented the efforts to reduce compliance costs in the supply chain of petroleum products and alcohol.

The third aim was to reduce logistics and transportation costs. Under GST, this was achieved by replacing Central States Tax (CST) with Integrated GST (IGST) for inter-state trade. This resulted in consolidation of warehouses, abolition of entry tax (octroi) and sharp reduction in transportation time and cost.

However, there are some dark clouds. As GST revenues started going south, both the centre and states decided to have a system of generation of e-way bills that would contain particulars of the goods and transportation. GST officers have been empowered to stop trucks, examine the bill and goods anywhere on highways. The scheme was implemented from April 1, 2018—first for inter-state movement, and later for intra-state movement. Trade and industry felt this was a disruption in the free flow of goods. In fact, instead of random highway checks, a better option would be strengthening of the Directorate of GST Intelligence so that the checks can be undertaken in specific cases based on intelligence and risk assessment. Another step to check evasion of taxes would be quick finalisation of the scheme of invoice matching.

The fourth aim was to make India a common economic market. In the pre-GST era, state VAT rates differed in different states. This led to distortions in investment decisions based solely on tax considerations. Entry tax and mandatory stopping of trucks at inter-state checkposts, coupled with different state VAT rates, were ideas contrary to a common economic market. These malaises have been remedied in the GST regime. Therefore, one can now look at India as “one nation, one commodity, one tax”.

The fifth aim that stemmed from the structure of GST was to have equitable growth of industry across the country. While some states were highly industrialised, there were others which were populous and lagged far behind. As GST is a destination-based consumption tax, in cases of inter-state trade, the state’s share of GST accrues to the destination state. Broadly, 40 percent of the country’s trade is inter-state and destination-consumption states, such as UP, Bihar and Odisha, will have more revenue from IGST, besides their own SGST for intra-state trade. Since these states would get richer in revenue, it is expected that this extra money would be spent in development of infrastructure and power generation, and thereby attract industries. Thus, in course of time, all these populous states would also become industrialised. Green shoots are expected in two or three years.

On the issue of technology support, it was clear from the beginning that for administering GST, a robust IT infrastructure would be sine qua non. Thus, we got GSTN, the IT infrastructure. The role of GSTN was to facilitate the administering of certain basic business processes like registration, payment, filing of returns and claiming of refunds. It was also to facilitate invoice uploading and matching of returns/invoices so as to ensure that the credit taken by the recipient was actually paid by the supplier. Given the huge responsibility on GSTN, it was expected that it would undergo test runs in respect of all the aforesaid business processes before implementation. However, the policymakers finalised all the business processes and formats only a few days before the target date for GST, thus leaving very little time for GSTN to make all the business processes operational on the day of implementation. Worse still, full-scale test runs could not be undertaken for all the operations before the day of introduction. There must have been some compelling reasons for the government to stick to the target date. But, the consequence was that there were many glitches in the GSTN system in the first month of implementation itself. As a stop-gap measure, some of the processes were made offline and a new simplified return, GSTR 3B, was put in place. The scheme of invoice matching for ensuring compliance was also postponed. To add to the woes of small and medium businesses, the much-publicised services of GST Suvidha Providers for helping them in their interaction with GSTN were also not made available. Thus, the first taste of GST implementation was bitter. All these things could have been avoided if the implementation had been deferred by two months.

As for policy issues, by and large, these worked out well except for some monumental blunders. One was with regard to small business. First, the threshold exemption for small business was the lowest in the world at only Rs 20 lakh. Internationally, the threshold varies between Rs 80 lakh and Rs 1 crore. Then, there was a decision that there would be no threshold exemption for inter-state trade. It meant that the moment someone did inter-state supply like, say, from Okhla in Delhi to Gurgaon in Haryana, he would forfeit the benefit of threshold exemption of Rs 20 lakh, and he would have to pay GST and all the compliance requirements. So, many small businesses decided to stop inter-state trade but in the process, they lost business in a big way. Their business shrank for another reason—reverse charge mechanism. Big businesses were mandated to pay GST and meet all compliance requirements on behalf of the unregistered suppliers (read small business below the threshold). The result—big business stopped transactions with small suppliers. Coming soon after demonetisation, this broke the back of small business. On a rough estimate, small businesses contribute around 75-80 percent of total employment in the country.

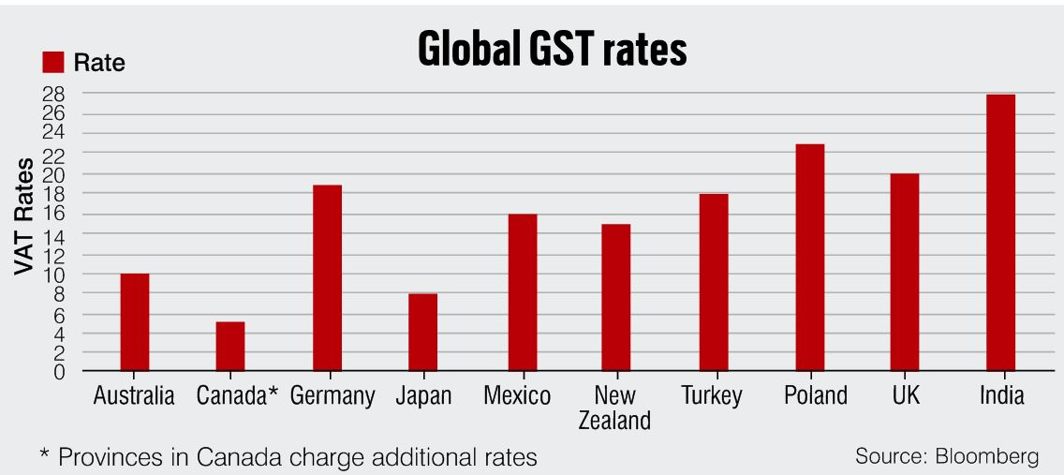

Now let’s come to GST rates. Leaving aside the exempted goods, GST has a four-tier rate structure—5, 12, 18 and 28 percent. Broadly, the rate structure is based on the principles of “capacity to pay” and “who uses those goods”—very poor, poor, common man, rich and super rich. Besides, most of the items in the 28 percent slab also suffer a compensation cess—a cess collected by the centre to compensate states for the revenue loss after implementation of GST. Most countries, except Australia, Singapore, Malaysia, and some others, have more than one GST/VAT rate (mostly two slabs); France has five slabs. In a country like India where people are at different economic levels, it is appropriate to have four slabs. Of course, there is scope to reduce the slabs to three after GST settles down next year. As for the items put in different slabs, there were many discrepancies. Too many items were put in higher slabs of GST, and there was discontent.

In the light of these issues, there were protests across the country. Small business was the worst affected. So were exporters when huge amounts of export refund claims were blocked because of the skewed procedure. This compelled the GST Council to undertake a series of course corrections.

First, the clause regarding withdrawal of exemption in the case of inter-state supplies which affected small businesses most was suspended. Also kept in abeyance was the clause relating to reverse charge mechanism. These provided some relief to small business. Further, relief was provided to the MSME sector by expanding the scope of the composition scheme. The upper limit of eligibility was raised to Rs 1 crore. Export procedures were also simplified and certain innovative export facilitation schemes were outlined.

The list of items in different slabs of GST was also rationalised. Initially, there were more than 250 items in the 28 percent slab. But by November, 178 items were taken out of this highest slab and put in lower slabs. Similarly, many items in the 18 percent and 12 percent slabs were brought down to the 12 percent and five percent slabs, respectively.

IT glitches, irrational tax structure and certain policy glitches jointly contributed to giving a bad name to GST in its initial months of implementation. However, it is creditable that the GST Council acknowledged the mistakes and undertook immediate course correction. GSTN too got into the act quickly. As of now, their challenge is to provide a seamless e-way bill system, finalise the formats of returns and provide an effective invoice-matching mechanism.

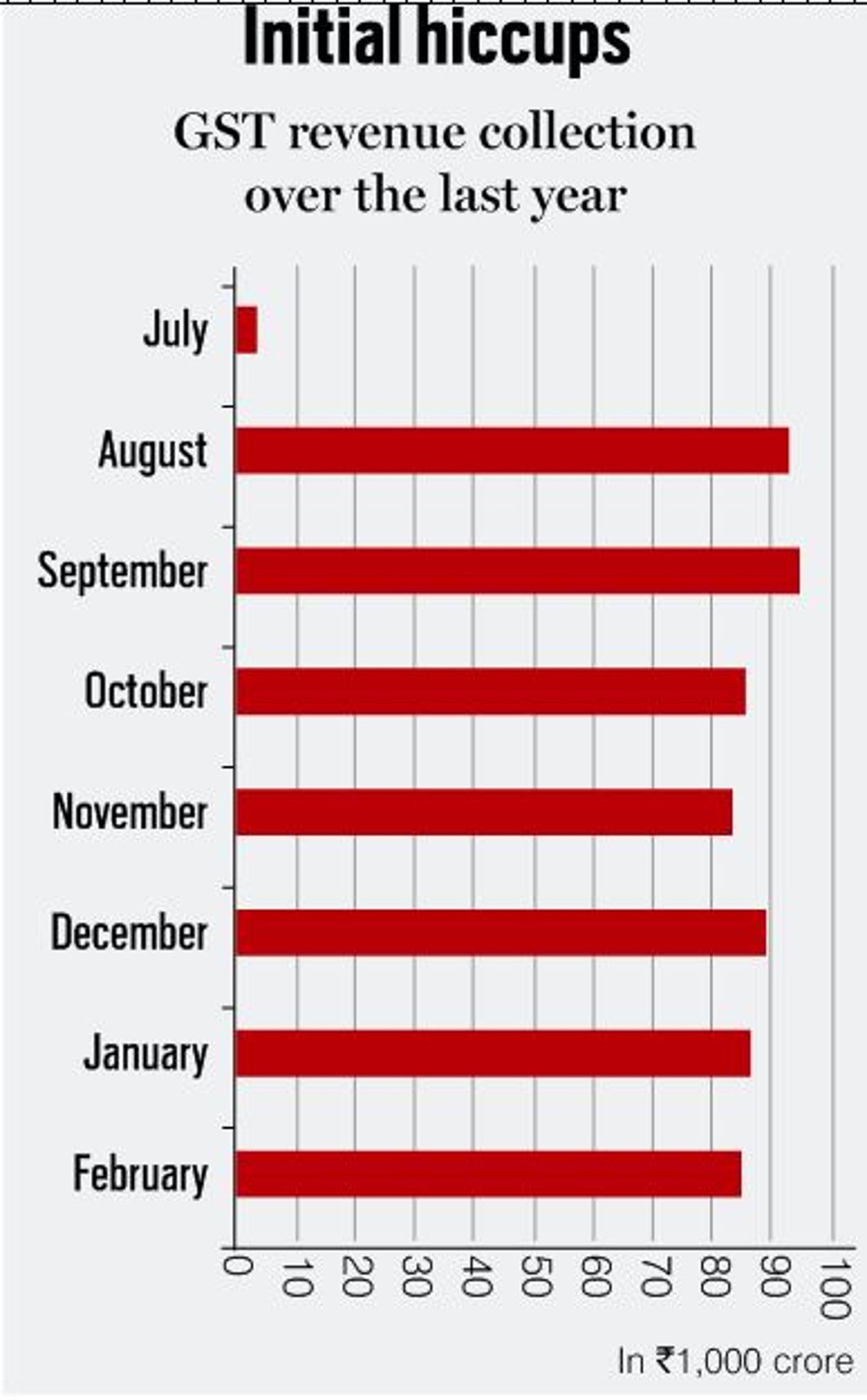

Finally, let’s come to GST revenue collection. It is a given that in almost every country, in the first year of implementation, GST revenue collection takes a dip due to various reasons related to beginner’s hiccup. Notably, GST collection was higher in the first three months of implementation—Rs 93,590 crore, Rs 93,029 crore and Rs 95,132 crore in July, August and September, respect-ively. It fell in October and November to Rs 85,931 crore and Rs 83,716 crore, respectively. Then the collections picked up a bit in December with Rs 88,929 crore, only to fall in January and February at Rs 86, 318 crore and Rs 85, 174 crore, respectively.

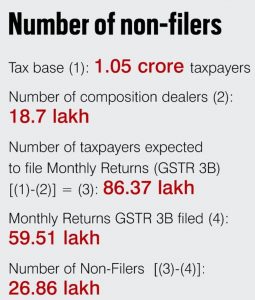

As for the tax base, 1.05 crore taxpayers have been registered till March 25, out of which 18.17 lakh are composition dealers who are required to file returns every quarter. Thus, the balance of 86.37 lakh tax-payers were required to file monthly returns. As against this, only 59.51 lakh filed GSTR 3B returns for February. This is around 70 percent of the total expected returns, which means there are around 30 percent non-filers. Among them, a good number would be those who got registered as per the law on threshold in the beginning, but came out of GST after the clauses relating to inter-state supply and reverse charge mechanism were amended. Leaving them aside, there will be a substantial number of non-filers who could be potential tax evaders. There has also been evasion by way of misutilisation of input tax credit, particularly during the transition period. Therefore, a more active role for Directorate General of GST Intelligence and quick introduction of invoice matching will have to be considered on top priority to catch these tax evaders. Surely, introduction of the e-way bill cannot be a substitute for the measures mentioned above; it will at best be a clumsy effort.

Notwithstanding the misadventure of introducing GST in July 2017 at a time when GSTN was not ready, efforts by the GST Council to set it right and rectify wrong policy decisions and skewed tax rate structure have made GST move ahead. Both the Council and taxpayers will have to look at the progress of GST as “work in progress” for at least one more year, and continue to take quick corrective action.

Though there seems a slow-down in decision-making by the GST Council, one would expect it to be as active, if not more, as it was in the months of September-October last year so that GST can move forward with alacrity.

—The author is former chairman, Central Board of Excise and Customs