Imposing a tax on startups is unfair as most don’t make it to the second stage of financing and angel investors bear the brunt of financial loss. It is imperative to provide them incentives lest they stop investing

By Sanjiv Bhatia

We live in the age of entrepreneurship. The vast majority of products, services and technologies we use today come from startups, and over 70 percent of global employment is attributed to these new-age entrepreneurs. It is vital for policymakers to understand how this ecosystem works and how to incentivise it to generate maximum economic growth and employment.

Capital is the lifeblood of any new business. The various sources of finance available to entrepreneurs include their own resources (bootstrapping), angel investors, crowd-funding platforms, accelerators, venture capitalists, private equity funds, banks, public grants, family offices and stock exchanges. Angel investors are the earliest stage providers of capital and provide more than just money to entrepreneurs. They provide know-how and mentorship, and share their network in contributing to the development of the business. They are thus the main drivers of innovation and a vital cog in the startup ecosystem.

Angel investing is, however, risky business. Ninety percent of startups don’t make it to the second stage of financing, and angel investors have to bear the brunt of the financial loss. Providing the right set of investment and tax incentives to angel investors is, therefore, a necessary condition for a thriving startup ecosystem.

In most countries, the capital invested by angel investors is not taxable because it is not considered income. The amount an external investor puts into a company, either as debt or equity, goes on its balance sheet, not the income statement. As a result, it is not a part of taxable income. But in India, there is an angel tax (yes, paradoxically that is the true name), where a 30.9 percent tax is levied on investments made by external investors in startups or other small companies. To clarify, the entire investment is not taxed—only the amount considered above the “fair value” is classified as “income from other sources” under the Income Tax Act (Section 56).

So, assume that an angel investor puts in Rs 1 crore in a startup in exchange for 10 percent interest in the company. If the tax authorities deem the fair value of that 10 percent shareholding to be Rs 60 lakh, then the company (read entrepreneur) will have to pay 30 percent tax on the amount above the deemed fair value—in this case, on Rs 40 lakh.

The angel tax was introduced in 2012 by then Union Finance Minister Pranab Mukherjee (of retroactive tax fame). It was put in place to arrest money laundering. Given that there are a million other ways to launder money, it is hard to understand how taxing a small startup company will stop money laundering. And even assuming there is some money laundering (best estimates are around 5-10 percent of total angel investing), why tax the entire ecosystem? Why throw the baby out with the bathwater? Creating rules and regulations to try and plug every loophole seems to be a fixation with Indian bureaucracy and policymaking. Demonetization adversely affected an entire nation, in attempting to go after a small percentage that evades taxes.

A recent survey by the Indian Private Equity & Venture Capital Association found that a whopping 73 percent of startups received notices to pay angel tax. Take the example of Clifon (name disguised), a startup that is developing new-age artificial intelligence software. The company raised Rs 1.5 crore from an angel investor. The tax assessment officer decided that the “fair value” of the investment was only Rs 1 crore, so the remaining Rs 50 lakh would be taxed as income, and Clifon would have to pay 30 percent tax on this.

There is an appeal process, but as per law, Clifon founders have to pay up 20 percent of the tax at the time of filing an appeal. Most founders do not have this kind of money, which then allows the tax authorities to go after the personal assets of the startup’s directors if they don’t pay up. “You raise Rs 1 crore, and then you have to spend Rs 5 lakh on tax consultants and lawyers. It is an unnecessary distraction. Instead of spending time developing our product, we are spending time arguing with income tax officers whose major objective is to shake us down,” said one entrepreneur.

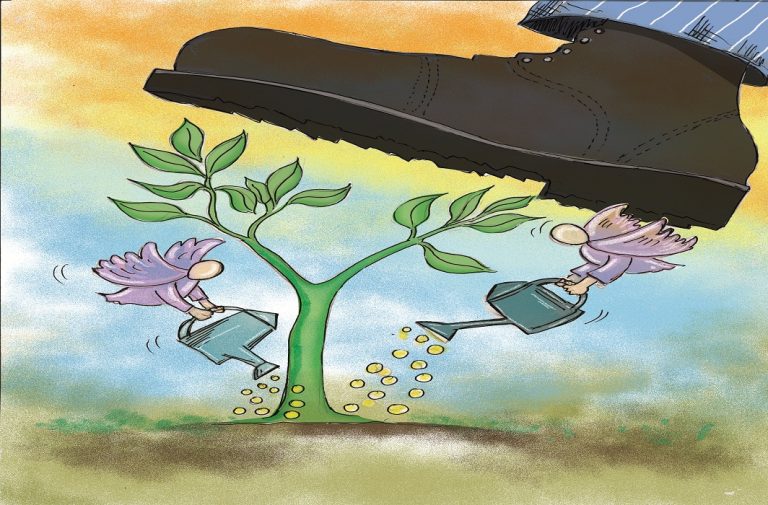

Investors, too, are wary. Many angel investors have been asked to furnish details about their source of income, bank statements and other financial data. It is forcing many angel investors to shy away from providing financial support to startups. Estimates by Inc42 Data Labs show that there was a 12 percent decline in early-stage investing from 2016 to 2017 and a whopping 47 percent decline from 2017 to 2018. Talk about killing the goose that will lay a golden egg. Startups are like saplings that eventually grow into big trees and bear fruit. Trampling on them for a few extra rupees in taxes makes no sense from a tax policy perspective. Google (and its 85,000 employees) paid almost $20 billion in direct and indirect taxes to the US Treasury last year. It, too, was a startup 15 years ago. Thank God short-sighted policymakers didn’t kill the company back then to collect a few thousand dollars in taxes.

Not only does the angel tax make no economic or accounting sense, but the arbitrariness of the assessment process is also disturbing. Tax inspectors have complete freedom to assess the fair value of a startup. Most startups don’t make any money for the first three or four years, so there is no way to model its fair value using either a discounted cash flow model or the net asset value method. The best assessment of value is what the market perceives it to be. Therefore, the price paid by the angel investor, which is a function of many variables including the company’s projected earnings, the strength of the management team and other intangibles is the fair value of the company. Why would an angel investor pay more than what he perceives to be the real value—if anything, a smart investor would pay less. How could a tax inspector, with no knowledge of the startup, come up with a better assessment of its fair value than the angel investor who is risking his capital?

Even though the Modi government did not initiate the angel tax, it has had five budgets to fix it, but has not attempted to kill the tax. Only recently, when faced with the reality of high unemployment (and pressure from the startup industry), has the government woken up to the absurdity of the angel tax. It recently said that no coercive action would be taken to recover the tax demands and has set up a committee to review the entire issue. Slight modifications were made to the tax in 2018 and exemptions granted for approved startups that obtain a valuation certification from a merchant banker and where the angel investors were approved as accredited investors by an Interministerial Board of Certification.

This is just more bureaucracy and hurdles for both entrepreneurs and angel investors. Why not just get rid of the angel tax? No other country has such an unnecessary tax because they use the criminal justice system to address issues like money laundering and black money instead of adding unnecessary and burdensome regulations to the tax code.

In Australia, for example, angel investors are allowed to deduct 20 percent of their investment in a startup as expenses from their income tax (up to a maximum amount). Also, if an investment is held for between one to 10 years, they don’t have to pay any capital gains realised from their investment. China has built a robust manufacturing ecosystem by allowing angel investors to deduct 70 percent of their total investment from taxation two years after an investment is made in high-tech startups. In the US, startups are permitted to defer any tax liability incurred during the critical first five years and to apply that tax liability at any time over the ensuing 20 years. In Germany, startups can expense 100 percent of all business-related capital, equipment, real estate and research and development investment in the first year.

India needs a serious rethink of its tax policy and the impulse to coercively extract every available rupee in taxes. The rules and regulations to ensnarl a few black marketers have become a burdensome straitjacket for businesses. No country in history has taxed itself into prosperity and anyone who thinks that increasing tax collection will magically transform India into El Dorado, the mythical city of gold, does not understand economics. I have repeatedly written about the need to simplify India’s tax laws, including the elimination of income tax, corporate tax, capital gains tax and substituting it with a simple 10 percent value-added consumption tax on all goods and services consumed in the country.

And there is no better place to start the tax simplification process than the startup ecosystem—the most critical component of the modern economy. Angel investors support entrepreneurs in starting up, and they support SMEs as they scale up their businesses, creating hundreds of thousands of new jobs in the process. In 2018, the US had more than 3,50,000 angel investors investing $25 billion in startups. And more than 3,00,000 angel investors put more than six billion euros in Europe. In contrast, India had less than 1,000 startup investments in 2018.

The government needs to eliminate the angel tax and create tax incentives for early-stage investors to promote an entrepreneurial and risk-taking culture that is vital to propel the economy. Let’s nurture these saplings so they can bear lots of fruit later. That is sound economics and sound tax policy.

—The writer is a financial economist and founder, contractwithindia.com

What will it take for policymakers to realise the unfairness of many of India’s tax laws. We need people who understand how to grow the pie rather than get those who keep finding new ways to divide it.

I agree with the author about India’s obsession with black money. As a student of the Indian economy I am surprised at the powers tax officers have in your country. Every business person I have interviewed has horror stories about the extractive tax inspectors. If you want to develop your economy tax policy needs to be redone and the consumption tax might be the least obtrusive way to go. Business will flourish but the tax officers won’t make money from bribes..!! You have a choice to make–economic growth or tax terrorism.

Good article. I hope someone in govt is paying attention. How can we create jobs if we keep taxing the people that create them.

Comments are closed.