By Shivanand Pandit

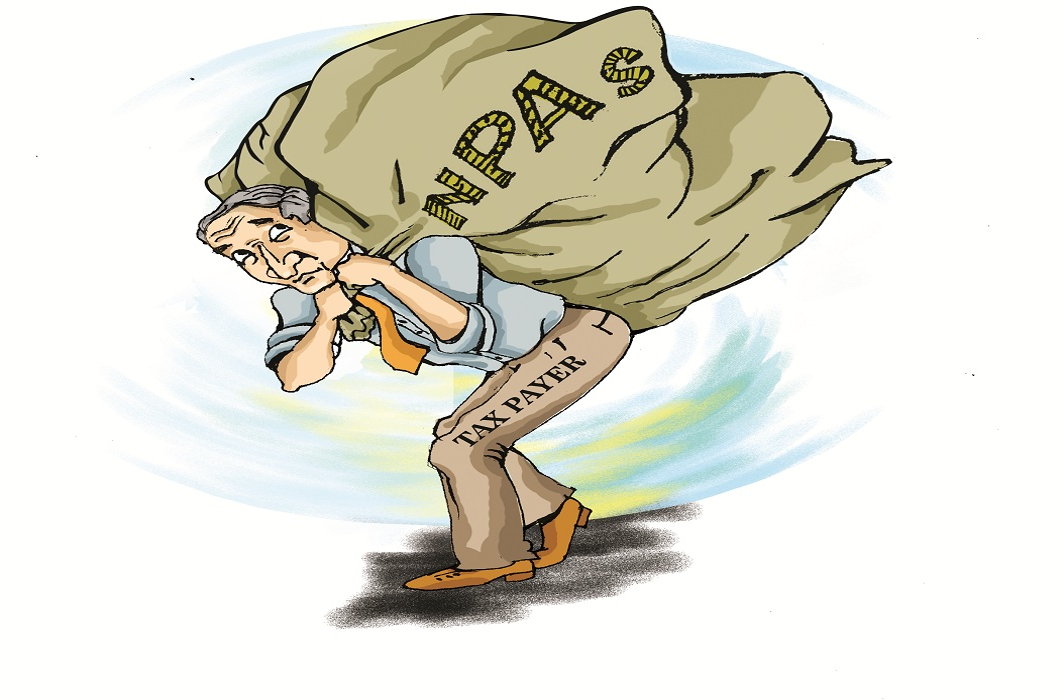

To guide state-owned banks in taking accountability for non-performing assets, the finance ministry recently published a new set of standards and issued the “Staff Accountability Framework for NPA Accounts up to Rs 50 crore (other than fraud cases)”.

The main objective is to safeguard employees for genuine actions and make them responsible for any misconduct or indecision on their part. The new rules will come into effect from April 1, 2022, for accounts that turn NPAs commencing the next financial year. The ministry has guided public sector banks to amend their staff answerability, strategies and design measures with the consent of their respective panels.

According to the framework, banks will have to finalise an accountability exercise within six months from the date an account is categorised as NPA. The rules recommend maximum levels for examination of accountability by the chief vigilance officer depending on the bank’s business volume. The guidelines have also mentioned that if the NPA is triggered by external issues, namely change in government policy, natural calamities, non-release of government subsidy or grant, etc—it should not attract staff accountability scrutiny.

Also Read: Embracing the Rainbow

The ministry decided to make this move to guard bankers and erase their anxieties of being probed for bona fide business decisions gone incorrect. Numerous bankers are of the opinion that occasionally decisions on credit approvals are slow as they fear investigative organisations may chase them if the accounts turn NPA. Considering this trend, the Indian Banks’ Association (IBA) said that this tactic not only upsets the confidence of the employees, but also places enormous stress on the resources of banks. The IBA also mentioned that disciplinary action should be taken against those officers having wrong intentions or connections, while authentic mistakes have to be handled with kindness. These bankers have offered their feedback to the government.

Due to Rs 13,000-crore mega fraud committed by Nirav Modi in 2018, many senior officials of Punjab National Bank faced stringent prosecution. In addition, other isolated scams created an atmosphere in which PSU banks became exceedingly careful and risk-averse even in the case of genuine corporate advances. This led to a delay in credit deployment, which is vital to encourage economic progress. This scenario is what forced the ministry of finance to issue the new framework.

Presently, banks carry out different methods for staff accountability exercises in case of NPAs. This adversely influenced many bankers and they are hesitant about taking on fresh units or projects. Therefore, credit off-take to petty units that need bank funding were deprived of liquidity, particularly after the pandemic started.

According to the new framework, staff accountability need not be verified in unsettled NPA accounts up to Rs 10 lakh. The government has said that most loans up to Rs 10 lakh are “template-based and do not form a key percentage of the NPA group by amount. Such accounts can turn into NPA even due to a minor modification in situations including health crisis, shutdown, etc”.

Also Read: Bahraich court sentences man to death for raping minor daughter over two years

For observing staff accountability, subject to business volume, banks may decide on a threshold of Rs 10 lakh or Rs 20 lakh. For loans between Rs 10 lakh and Rs 1 crore, which largely comprise home and car loans, small and medium enterprises and agriculture credit, staff accountability is to be observed by a team established at the regional or controlling workplaces. For initial scrutiny, the controller will submit a brief statement comprising particulars of the loan and comments in inspection or audit reports for the preceding four years. If the committee locates a case of staff accountability, it will be scrutinised by a fact-finding officer.

Accounts in the range of Rs 1 crore to Rs 50 crore are generally credit amenities sanctioned to business firms, demanding inspection by a specific committee within the banks. NPA accounts in this assortment should go through initial scrutiny by a committee formed at one level over the sanction level. So an account approved at the regional office will be taken up at the zonal level, those at the zonal level by circle office or head office and so on. The committee should be controlled by an authorised senior to the approving authority. For initial scrutiny by the committee, a detailed report should be submitted through the controller. If the committee detects gaps in any of the procedures, the account may be referred at the choice of the committee to the controlling audit office for a thorough inspection of staff accountability.

For NPA accounts above Rs 50 crore, staff accountability is to be scrutinised as per the prevailing rules. However, the RBI has designed an outline as per which banks must start and finish a staff accountability exercise within 180 days from the date of grouping the scam. Facts of the exercise and the decision taken may be put before a special committee of the Board for monitoring and follow-up of frauds and informed to the RBI at quarterly intermissions. The RBI mentions that banks should separate all scam cases into vigilance and non-vigilance classes. Only vigilance cases should be referred to inspective authorities. Non-vigilance cases may be probed and dealt with at the bank level within 180 days. In cases comprising very senior managers, the board or the audit committee may start the procedure of fixing accountability, which should not be delayed due to the case being filed with law-enforcement organisations.

Banking industry experts and officials are of the opinion that the new framework will assist bankers to take credit decisions quickly, which will support the economy. The finance ministry also mentioned that a developing economy depends deeply on bank advances and the government and the RBI also have at different times declared their worry on slow credit off-take and emphasised the removal of fear in taking business judgments. The ministry also said that rational and clear systems and processes of organising staff accountability are essential to erase bias.

Resolving the accountability issue of PSBs is a praiseworthy move. However, the government should introduce broader reforms to tackle fundamental matters. These include reinforcing banks credit-appraisal system to improve credit pricing skills and lessening loan write-offs, commanding the RBI to govern PSBs like private banks, assured functional independence and proper opportunities to defend in case of an investigation and linking job inducements with commercial outcomes. All these measures will enhance the lending confidence of PSBs, inject discipline among them, reduce NPAs and scams, improve functional efficiency and increase the valuations of banks put up for privatisation.

—The writer is a financial and tax specialist, author and public speaker based in Margao, Goa