By Sujit Bhar

The massive deal Air India struck with Boeing and Airbus to purchase 470 aircraft—this will be the biggest aircraft deal ever—has made headlines. The airline also has the option of acquiring another 370 aircraft. Estimates of the total cost of purchase—all negotiated at a deep discount, considering the order size—have varied between $80 billion to $100 billion.

Two questions have been raised following this news. The first is: how will Air India finance this deal? The second is: can the Indian and world passenger growth rate absorb such massive capacity extension for Air India, a full service airline?

Before moving further, one needs to get an estimate of the deal size. To do that one can refer back to the overall performance of the entire Tata group. The annual revenue of the group for fiscal year 2021-22 was reported to be $128 billion. This estimate has been derived from revenues of 29 publicly-listed companies of the group with a combined market capitalisation of $311 billion as of March 2022.

With this backdrop, is this deal an impossible one? In the face of it, that is how it seems. However, technically, this comparison is fallacious, as we will see later.

Show us the money

Instead of asking whether Air India has the money to buy all those planes, we need to ask whether it needs to have that much cash at all. In the world of international financing, it is all about Other People’s Money, or OPM. Let us see the options before Air India and the Tata group.

Air India is a very old company, and most of its assets, or aircraft, have been fully paid for. The first and obvious option could be to use these aircraft as leverage to get loans. The aircraft could be mortgaged to banks and the money received could be used to buy new planes. That is the easy way, but it cannot buy that many planes, especially when, after depreciation, many of its assets have already lost much of its value.

What about debt?

The second obvious option is debt. Air India and the Tata group had to pay Rs 18,000 crore to buy Air India after the government made the terms of the debt—Air India was almost crushed in debt before—less onerous for the buyer. The Tata group, a salt-to-software-to-steel conglomerate was the one that had founded the airline in 1932 before it was taken over by the government in 1953. Despite the cost price, and despite Air India coming into the group with already a good deal of debt—even if it had been restructured—on its books, the Tata group’s overall credit rating has been very good internationally. Hence it can get loans at very reasonable interest rates.

However, since the Tata group isn’t like another shady group in the news these days, it would not want to dump another burden of debt on its books. Hence, while debt cannot be avoided, the debt portion within the deal will have to be smaller, so the rating agencies do not start creating a fuss.

Sale and leaseback option

It has been revealed that the group wants to fund purchases of the narrow-bodied jets (mostly for the domestic market, and for locations in neighbouring countries) through an instrument called sale and leaseback (SLB). This is an interesting option which in India is called sukhe me nao chalana, or rowing a boat down a dry riverbed. In the real world, it is about acquiring assets without paying any money. As it turns out, that is possible.

Buying a hugely expensive aircraft isn’t exactly like buying a pair of jeans from a store, where you choose the pair of trousers, have the cashier swipe your card and it is all yours. You cannot just produce hundreds of millions of dollars from your bank account. And if you are an astute businessman, you definitely wouldn’t.

How this works can be explained by a simple example. In 2020, when the Coronavirus was ravaging entire airline industry across the globe, the Chicago-based United Airlines wanted to buy 22 aircraft with money it didn’t have. What it did was do a couple of deals. One was a discounted price deal with the aircraft maker Boeing and another with the Bank of China (BoC) Aviation, which agreed to finance the deal. A normal financing deal would have resulted in a huge debt on the books of United, or in BoC taking an equity position in United. Neither looked appealing to United’s stakeholders.

The third option was an SLB, through which the BoC would pay United the cash to buy the planes from Boeing, but United would immediately sell it to BoC. The second part of the deal was a simultaneous contract that allowed United to lease the planes back from BoC for a monthly payback.

The interesting part is that BoC Aviation does not fly planes. When the lease period ends and the planes are fully paid for, the planes are returned to United (on books), or are sold off to another airline and the proceeds are used for another set of purchases. As for BoC, lease payments will far exceed the price it paid for the planes in the first place.

Squeezing out the money

The other fun part of this deal emanates from the huge deals that airlines strike with manufacturers. India’s IndiGo Airlines is a case in point. It was set up by Rahul Bhatia of InterGlobe Enterprises and Rakesh Gangwal, a United States-based NRI. In June 2005, when it hadn’t even operated a single flight, it placed a firm order for 100 Airbus A320-200 aircraft. In July 2006, IndiGo received its first aircraft and commenced operations on August 4, 2006. Airbus, in those days, was coming out of a confidence crisis and it desperately wanted this order. The French company managed to complete its order way ahead of schedule. The discount that IndiGo managed from the aircraft manufacturer and the engine manufacturers was reportedly to be in the region of 50%.

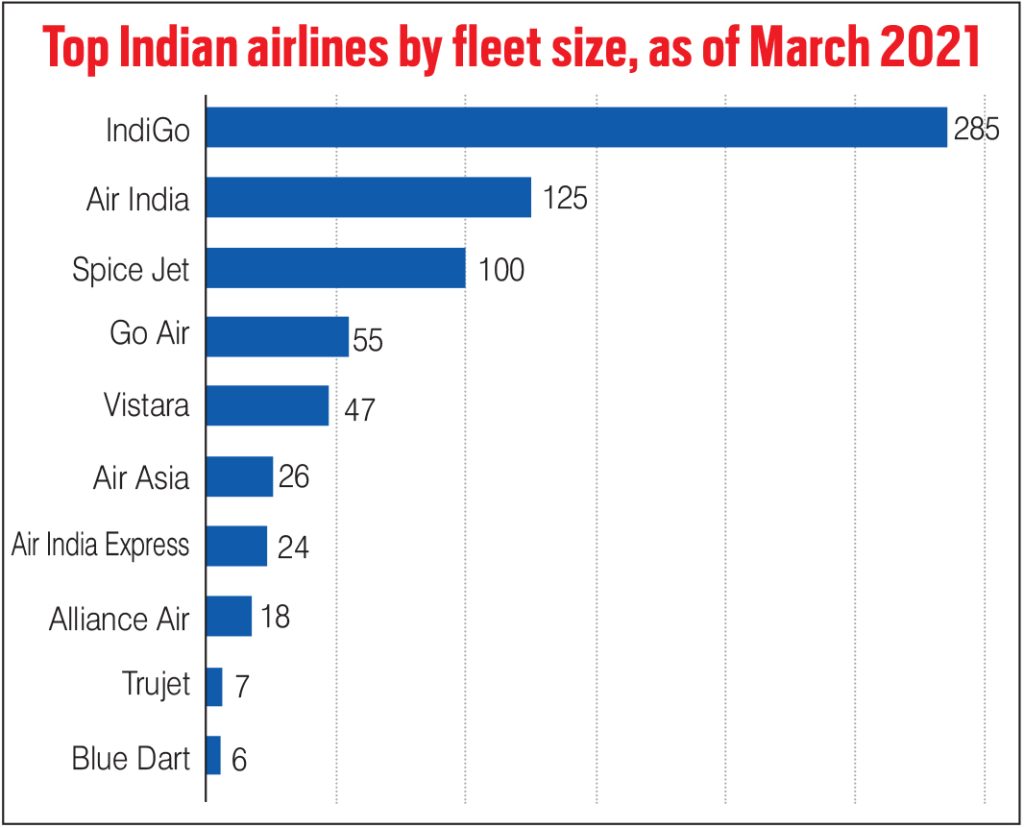

The entire deal—worth in the region of $8-10 billion— was being financed by a consortium of banks and financial institutions. IndiGo passed on some of this discount to the banks. So the banks now held a great deal of asset at a large discount to market price. The excess from the original funding (difference in the discount amounts) was cleverly used by IndiGo for a part of the operational cost, spending on things such as airport parking bay, plane maintenance annual contracts, pilots, cabin crew, maintenance crew, handlers and ticketing staff (IndiGo managed to bring its per plane staff-count down to an amazing 96). Excellent money management has now made IndiGo by far the largest airline in the country.

The tricky side

Kingfisher Airlines too used the same sale and leaseback instrument, but it was a full service airline, with all fineries added. Money management was poor and the airline bled from the word go. The rest is history.

The problem is that Air India is also a full service airline, and this order is large enough to burn through the company’s books if money management is not very tight. One will not be surprised if Air India’s domestic circuit is developed on a low-cost budget system, while the international routes still get full service.

That apart, it must be realised that fuel cost is touching the skies these days, and that is the biggest component of any airline’s operational cost.

The other part of the order

It has been reported that Air India might want to go into outright purchase of the wide-bodied jets. This is considering the ever increasing lease rates. Such rates may be serviceable for lower priced narrow-bodied jets, but might be impractical when it comes to very expensive large planes. Yes, there will be debt on the books, but since an IPO is expected quickly in the future, this may be handled.

This can be estimated by the delivery schedule that AI has finalised. According an official of the airline (as reported in the media): “The first (delivery tranche) is short-term, which will happen this year and the first half of next year, which is about largely bringing in leased aircraft. We have 36 aircraft on lease, 30 of which are going to be wide-bodies. And they give us an immediate capacity boost.”

From the middle of next fiscal, Air India is expected to spend nearly $300 million in refitting its entire wide-body fleet of Airbus and Boeing aircraft. That will include a new seat in every class and in-flight entertainment.

The new orders start coming through in 2025, as part of a delayed inventory programme. In any big order in any industry sector, all the goods are not delivered at the same time. There will be large gaps in the delivery schedule worked out by Air India and the manufacturers, allowing for more fiscal management within the gaps. Recent reports say that while Air India Express may be able to report an operational profit in 2023-24, Air India itself is on the brink of operational break-even or even profit.

Whatever the situation, when new stock rolls in, the company will have to hit the ground running.

Other financial options

If and when the profitability and credibility of the company is established in public minds, Air India has the option of an Initial Public Offering. That can bring in a lot of cash without strings attached, boosting the position of the airline.

Debt could easily be woven into the system slowly, keeping to a decent debt-equity ratio.

Air India has time for that. The aircraft assets being acquired should have an operational lifecycle of 15-25 years. And in that time, the assets can be sweated enough to draw out all the juice.

The maintenance angle

IndiGo did another interesting management trick. IndiGo’s initial planes were all narrow bodied, suitable for domestic channels. The planes were sweated exhaustively and in around five years the company had completed its lease contracts. That allowed the company to arrange the sale of these planes (still reasonably new), while ordering new ones.

This rolling of stock kept the planes pretty much new and fresh, pushing maintenance cost down to a minimum.

Air India surely would be keeping this in mind as it operates its new planes. The Tatas, meanwhile, have already used its excellent financial track record in securing Power-By-Hour (PBH) agreements with engine manufacturers GE and Rolls Royce.

PBH is an agreement between the operator and the suppliers in which the supplier agrees to provide a definite number of spares either at the operator facility or at common forward stocking locations. The operator pays the dues based on aircraft utilization. The operator benefits by not owning the item (spares), thereby, reducing inventory (and cost thereof) while assuring timely spares. The payments process also does not affect the books to any serious extent and this is a landmark strategy in lean inventory management.

Rolls Royce had actually discontinued this practice, because it never found it profitable. However, it has returned to old ways for this mega deal.

A young fleet

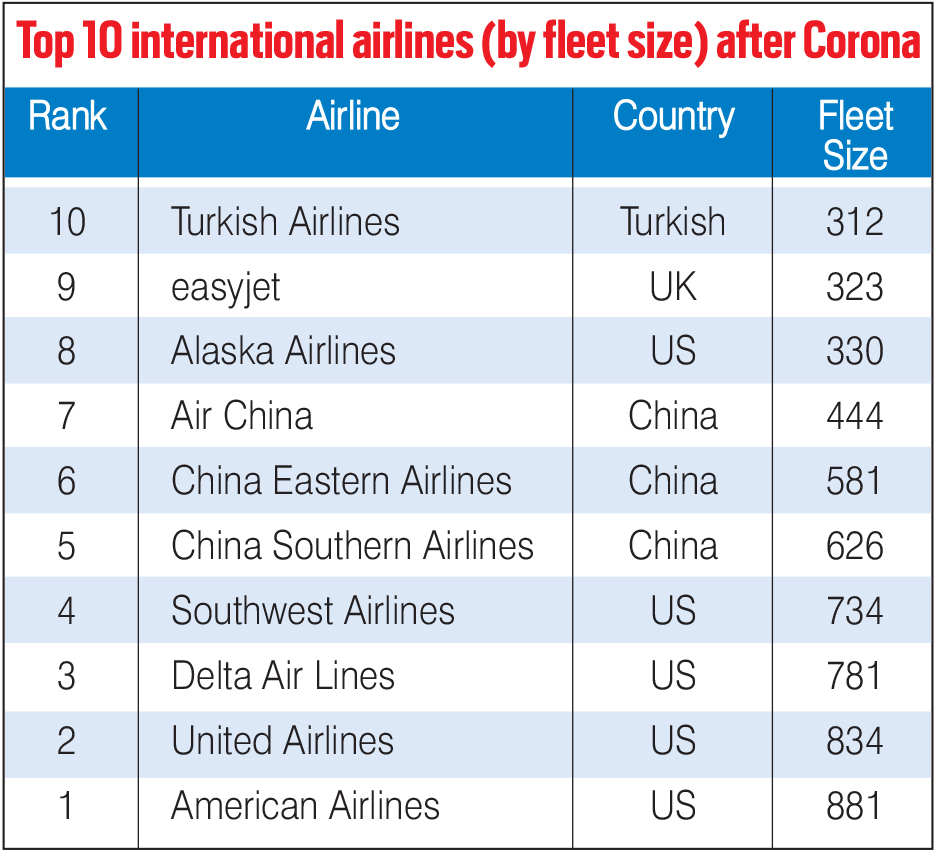

The above changes will allow Air India to offer one of the world’s youngest fleet with improved amenities. It is being said that Air India could end up owning 840 planes if it exercises its option of buying another 370 planes. That might not be the case. With changing of planes (old ones being replaced or sold), there will be executive decisions along the way that will either want more or less planes, depending on the current market condition.

Passenger growth projections

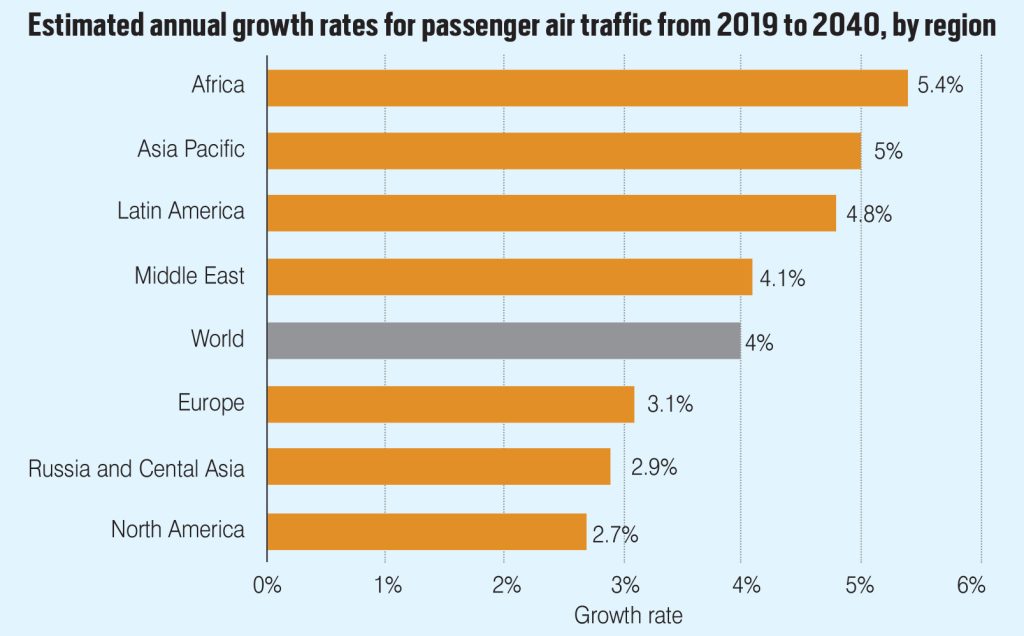

The entire purpose of the deal will fall through if the world economy and, hence, the passenger growth projections are grim.

The International Civil Aviation Organization (ICAO) says on its website that it used “advanced big data analytics… to forecast that air passenger demand in 2023 will rapidly recover to pre-pandemic levels on most routes by the first quarter and that growth of around 3% on 2019 figures will be achieved by year end.”

According to ICAO Secretary General Juan Carlos Salazar: “The air passenger forecasts ICAO is announcing today build on the strong momentum toward recovery in 2022, as previously assessed by ICAO statistical analysis…”

Data says that the number of air passengers carried in 2022 increased by an estimated 47% compared to 2021 (that is a baseline effect), while revenue passenger kilometres (RPK’s) increased by around 70% over the same period, due mainly to the rapid recovery of most international routes. In terms of airlines’ annual passenger revenues, keeping yield and exchange rates at 2019 levels, ICAO observed growth of an estimated 50% from 2021 to 2022.

On the domestic front, Fortune said on December 2022 that “Indian airports across the country handled 275 million passengers in 2019-20, but the following years saw a significant dip in air travellers due to the Covid-19 pandemic. The following year, 58.55% growth was seen as 167 million passengers across domestic airports. In 2022-23 till October, 147 million domestic passengers have already travelled, 96.5% growth over the same period last year.” All this data was revealed by General VK Singh (Retd) in a written reply in the Lok Sabha.

Finally, while the deal looks good, there will surely be headwinds ahead, though high turbulence cannot be ruled out the company should tighten its belt and not make mistakes that Kingfisher made.

—The author writes on legal, economic and corporate issues, apart from social commentary. He is Executive Editor at India Legal