By Inderjit Badhwar

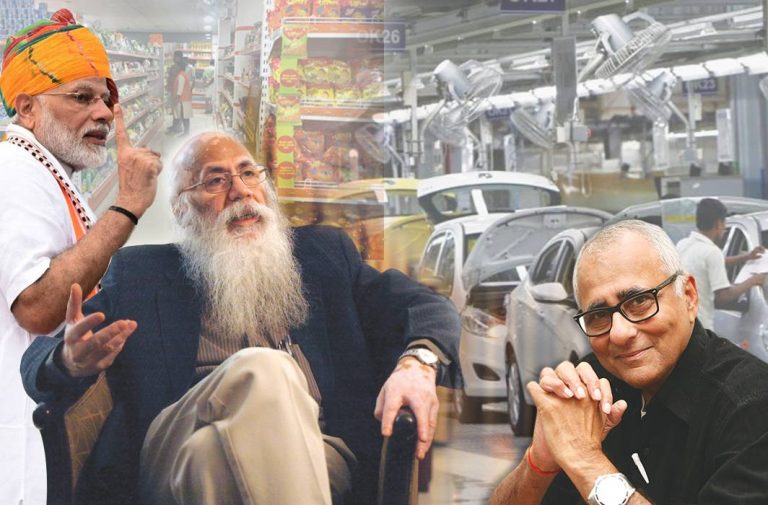

The million-dollar top-of-the-mind question in India, even as businesses and market analysts see no positive signs heralding a turnaround in the scary economic slowdown, is whether the country is in any shape to achieve Prime Minister Narendra Modi’s $5 trillion vision in five years.

It is a laudable target and there is nothing wrong in dreaming big. But targets and timetables must be based at least on a preponderant variation of possibilities. In order to seek some answers, we organised, last week, a private seminar to which we invited iconic Professor Arun Kumar who occupies the Malcolm Adiseshiah Chair at the Institute of Social Sciences in New Delhi. In the view of this eminent economist, the Indian economy may well be destined to reach that level but not in five years.

Before making optimistic predictions and indulging in feel-good hyperbole—vintage Narendra Modi—his spin doctors need to understand where India stands today and the steps that need to be taken in order to achieve that goal.

But where we stand today may be difficult to gauge in the currently vitiated atmosphere in which the Right to Information is being curbed, government-employed economic dissenters are being shown the door and disinformation appears to rule the commanding heights of the economy.

Do we, for example, have any reliable information on the rate of growth? This is a primary indicator without which projections and goals are simply an exercise in the blind leading the blind. But controversies continue to swirl around this fundamental question as the government mounts a fierce political challenge to those who insist that the Indian economy, like Humpty Dumpty, has tumbled off the wall and is on the path to a great fall.

But that is not all. A national controversy rages over the extent of actual unemployment and underemployment accelerating rapidly across all sectors of the economy. Rural distress is now being augmented by continuing losses of jobs in the manufacturing sectors, including the once-booming automobiles industry.

There is a surreal atmosphere of distrust as analysts begin to suspect official data. In fact, Professor Kumar says that the “assumption about the unorganised sector data included in GDP calculations is no more valid. If that is included appropriately, the rate of growth will be one percent”. Not 6.8 percent and a far cry from the optimistic 7.5 percent.

Is slowing growth a legacy issue? Did the government, as it has now been arguing, inherit a deteriorating economy? Is the international environment causing the slump? Kumar argues that the economy under previous regimes had gone up to 8 percent growth several times. The decline came only relatively recently. International factors are important but, Kumar asks, “are they crucial?”

After all, India was never an export-driven economy, thanks to pent-up internal demand which revved up after the liberalisation in the 1990s. In today’s economic circumstances, the RBI has cut interest rates four times and stock markets have been bullish most of the time, but investment has simply not picked up.

Kumar makes the following observations which every politician should heed:

- Due to the slowdown, revenues were short by Rs 1.6 lakh crore. To keep the fiscal deficit at 3.4 percent, the government cut back expenditure. But this only deepened the demand problem in the economy. Then the government played with the fiscal deficit figures to show a lower figure. The CAG says it is more like 5.5 percent. If states’ deficits are taken into account, it may be 8-9 percent. Hence, the capacity to raise expenditure is limited unless fresh revenue resources are found.

- The main factors behind the slowdown are gratuitous shocks administered to the economy: Demonetisation. The NBFC Crisis. Each of them impacted the unorganised sector which employs 94 percent of the workforce. When the income of such a large segment declines, the demand goes down.

- But now the slowdown is hitting the organised sectors. It has been particularly harsh on automobiles, FMCG, cement and freight. Credit off-take remains low. High NPAs have made the banks wary of lending. When the demand is down, capacity utilisation declines and investment is postponed. Interest rate cuts in this situation do not lead to higher investment. Note again: Stock markets have touched record highs but not led to higher investment.

- Another million-dollar question: Can the rate of growth be increased? Currently, the official rate of growth is 5.8 percent and slowing, WPI inflation is at about 3 percent. The nominal growth rate envisioned in the budget is nowhere close to the 12 percent assumed in the budget.

- So, revenue of the government will again be short. To keep the fiscal deficit at 3.3 percent, expenditure will likely be cut, and non-tax revenue may be increased via disinvestment and land monetisation. But this will still be inadequate. It is a transfer only, and does not lead to increased investment.

- What should be the rate to get to $5 trillion? The government is assuming a 12 percent nominal growth in its budget—this is unlikely. It is planning Rs 100 lakh crore of investment in five years. Again highly unlikely. Due to differential inflation between the US and India, the rupee may decline by 15 percent, taking the dollar to Rs 80 from Rs 70. In 2018-19, the economy was at Rs 190 lakh crore. By 2023-24 end, we will need to be at Rs 400 lakh crore. So, India will need 16 percent growth to achieve the $5 trillion mark.

- Given the international uncertainties facing India, looming trade wars, crises in oil producing countries… Modi has a tough row to hoe.